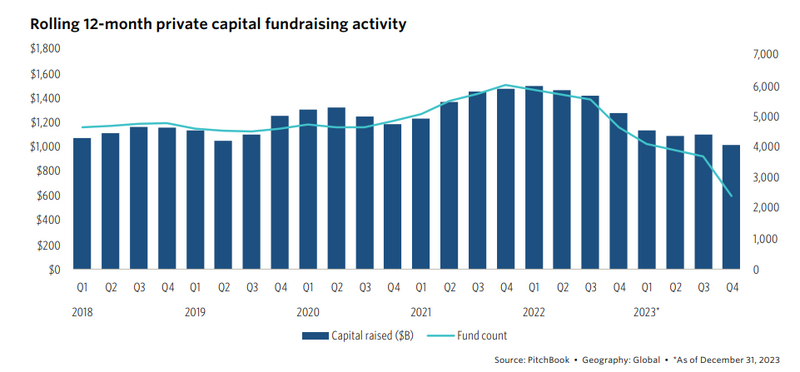

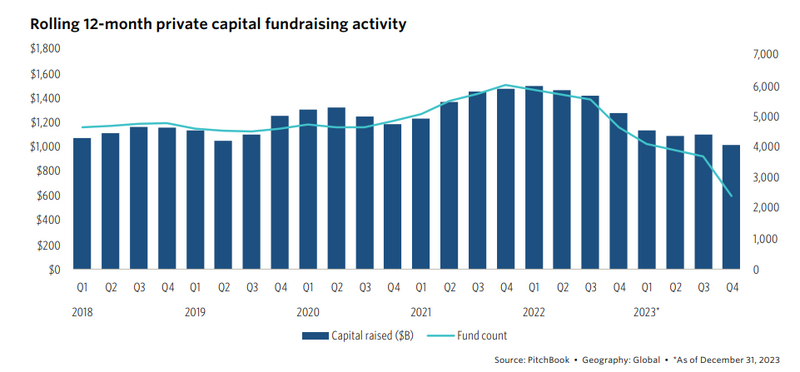

PitchBook’s 2023 Global Private Market Fundraising Report shows no surprise. Overall private capital fundraising was 20.5% lower than 2022’s totals with 48.4% fewer funds closed. “While 2023 totals will rise over the next year or so as more private fund closings are identified, it is safe to say it was not a record year for fundraising. The pain was not felt evenly”, explains Hilary Wiek, CFA, CAIA, Senior Strategist at PitchBook. In the good side, PE was only down 1.1% and secondaries raised 65.1% more in 2023 than in 2022, though on a fairly low base. The most challenged were VC, off 47.3%; real assets, down 42.9%; and real estate, which closed on 41.9% less capital.

That said, PitchBook highlights that despite recent fundraising downturns, there's a substantial amount of capital making private market investments beyond conventional reporting, particularly in the evergreen fund universe, which operates differently from closed-end drawdown funds. These funds tend to concentrate on income-generating areas like core real estate and private debt, leading to underestimation in reported capital. Additionally, there are other sources of capital, such as funds backed by sovereign wealth pools or corporate sponsors, which further complicate tracking efforts.

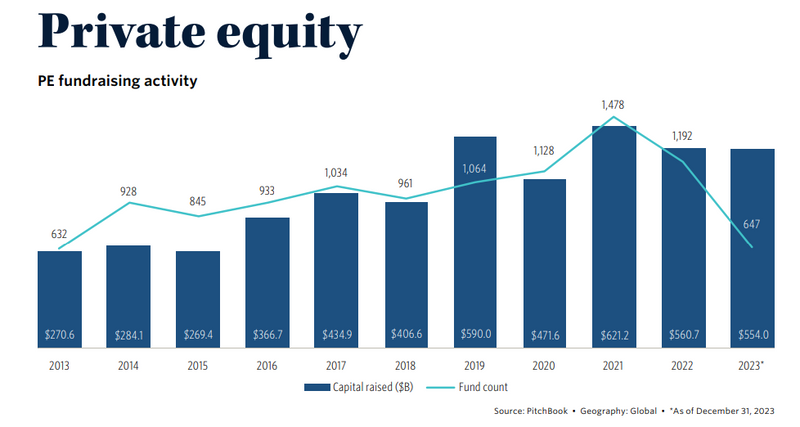

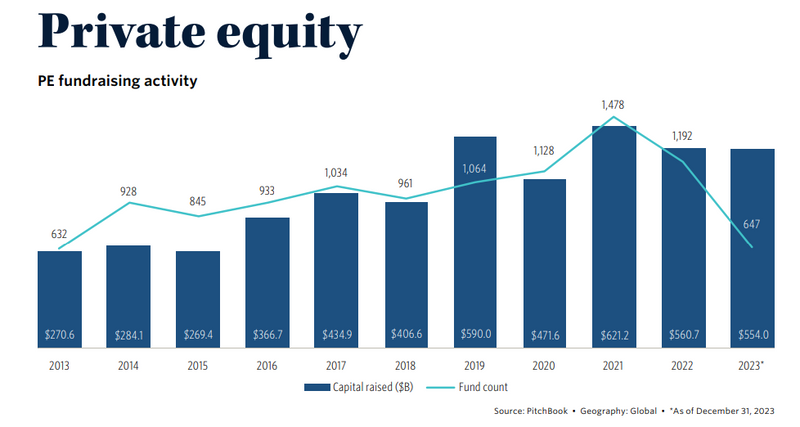

Private Equity Megafunds Took the Biggest Slice in Fundraising

In 2023, the landscape of private equity (PE) fundraising remained relatively steady, with a notable surge in the latter half of the year, signaling a 21.3% increase over the first six months. This resurgence was fueled by easing monetary policies and subsiding inflation in developed nations. However, higher interest rates constrained deal-making and exits, impacting distributions and prompting limited partners (LPs) to consolidate their investments, favoring managers with established track records. Notably, megafund vehicles, those exceeding $5 billion, accounted for nearly half of the total PE fundraising, a significant rise from a third of overall fundraising in 2020. Europe saw a remarkable concentration of fundraising, with CVC Capital Partners closing the largest-ever buyout fund in Q3, raising $28.6 billion. Meanwhile, North America witnessed significant megafund closures in Q4. As valuations adjusted, growth-expansion strategies waned, giving way to traditional buyout funds, with middle-market funds representing the highest share of PE fundraising since 2008. While North America continued to lead global fundraising, European fundraising surged by 33.4%, driven by substantial capital inflows from US-based firms like KKR and Bain Capital.

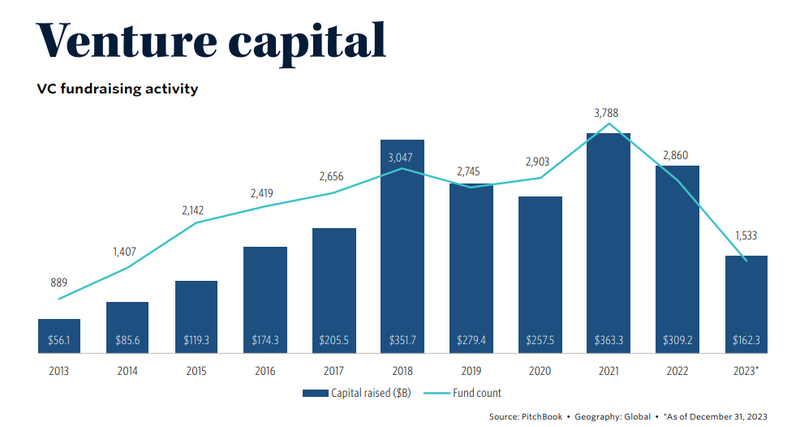

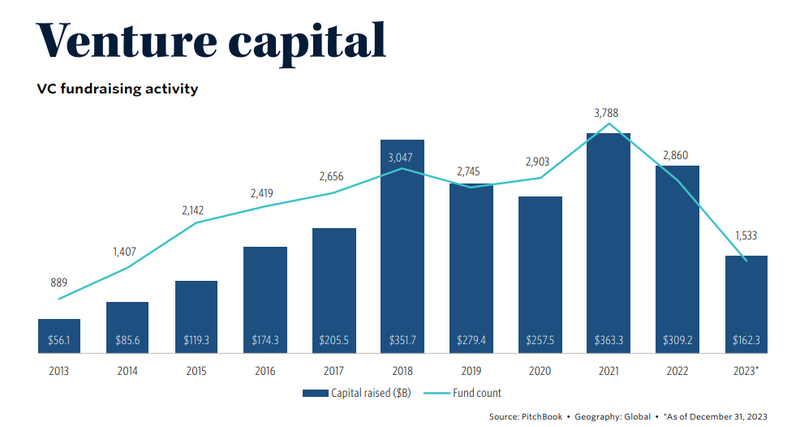

A Year for VC’s to Forget

In stark contrast, the global venture capital (VC) landscape faced a significant downturn in fundraising in 2023. Total capital reached $162.3 billion, marking a substantial 47.5% decline year-over-year, across 1,533 closed funds, down 46.4% from the previous year. This decline, attributed to a lack of funds exceeding $1 billion and a sharp decrease in capital raised by North America-based VC funds, reflects broader market pessimism amidst heightened costs and sluggish growth. North America's VC capital raised plummeted by 60.0%, signaling a tightening funding environment amidst unfavorable macroeconomic indicators. This downturn reverberated globally, with Asia- and Europe-based VC funds also witnessing declines of 21.8% and 42.4% year-over-year, respectively. Looking ahead to 2024, industry players will closely monitor exit markets, growth rates, economic conditions, and technological trends, all of which could shape fundraising dynamics in the upcoming quarters.

A Challenging 2023 for Real State and Real Assets

In 2023, private real estate fundraising faced a challenging year, with $83.5 billion raised marking the lowest point in commitments since 2011. Lingering concerns about the asset class's future were fueled by a market correction in the office sector, raising secondary worries about potential impacts on other sectors. Investor preferences leaned towards large funds managed by well-known entities employing proven strategies. Among the top 15 largest real estate funds, residential themes were most prevalent, followed by industrial investments and hospitality. Despite challenges such as high capital costs and labor shortages, investors remained optimistic about the sector due to a structural undersupply of housing in major markets and opportunities in areas like logistics and hospitality.

In 2023, real assets fundraising faced notable challenges, culminating in a 10-year low of $79.2 billion raised by 63 vehicles, despite a pickup in activity during Q4 driven by several significant closes. North America experienced the most significant decline in fundraising, with commitments halving compared to 2022, largely attributed to subdued activity in infrastructure vehicles. Among the top 15 largest real assets funds raised, decarbonization emerged as a dominant theme, followed by digitization and transportation, reflecting the evolving landscape of real assets investing.

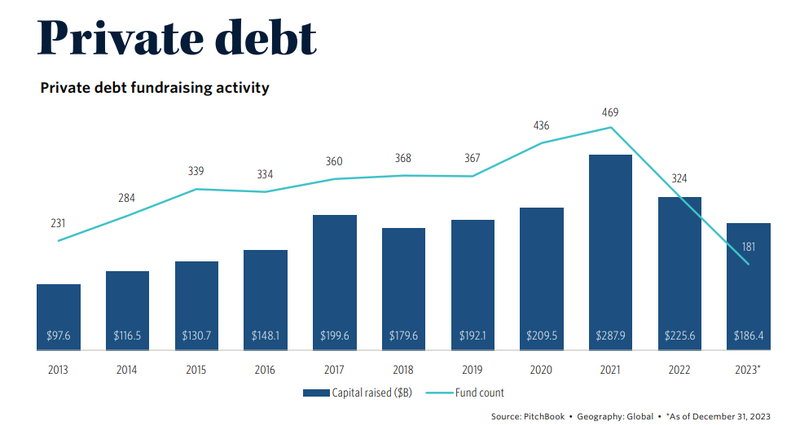

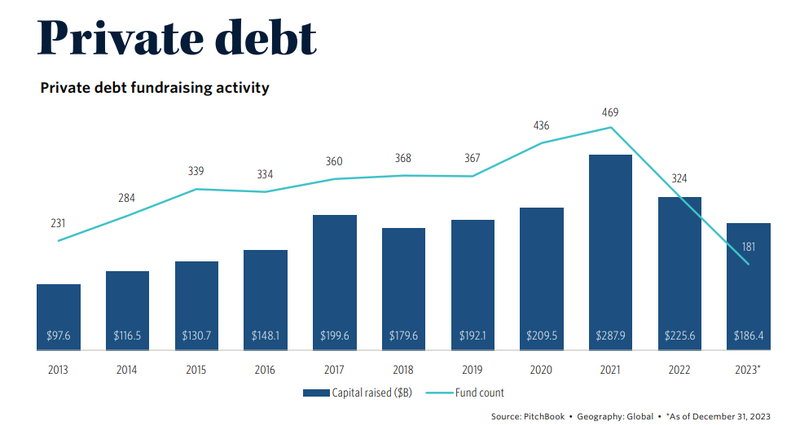

Private Debt Finishes the Year with Slightly Better News

Private debt fundraising in closed-end vehicles saw a notable rebound from a sluggish Q3, with a total of $42.5 billion raised during the quarter, marking a 29.6% increase. Despite adjustments for late-reporting funds, it's likely to be recorded as the slowest final quarter for private debt fundraising since 2016. Looking ahead, the industry anticipates bolstered fundraising totals as many rollover funds are expected to close in H1 of 2024. Private debt AUM surpassed $1.6 trillion as of Q2 2023, likely exceeding $1.8 trillion inclusive of semi-liquid funds for the retail channel. While concerns exist regarding the rapid growth and influx of new entrants, high-level analysis suggests that the share of emerging managers in private debt remains consistent with other asset classes.

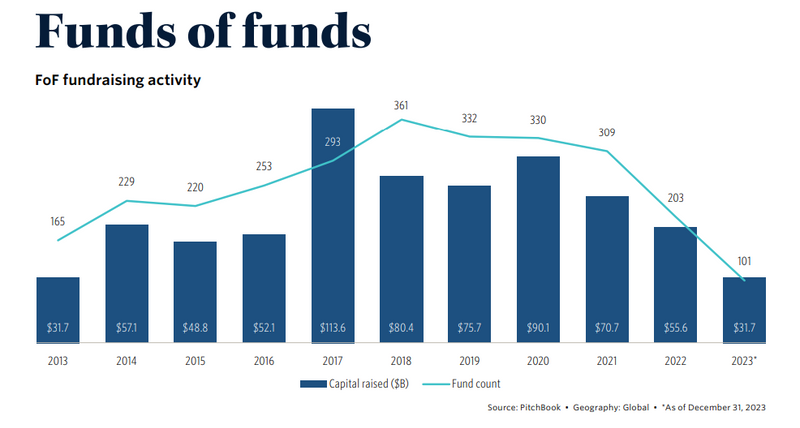

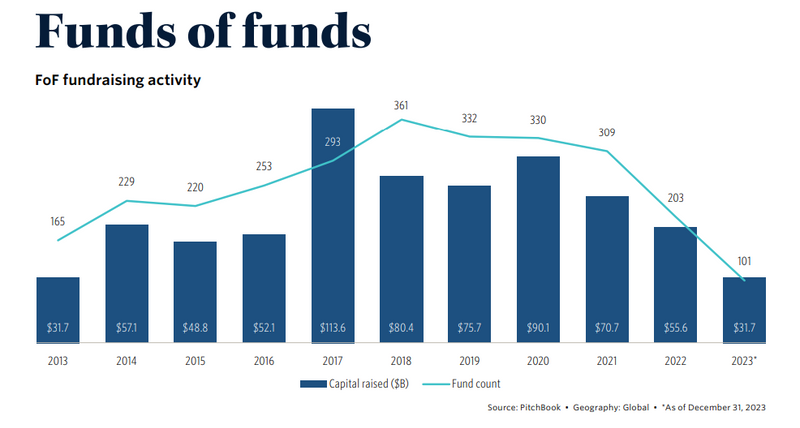

Funds of Funds Hit a Fundraising Low

In 2023, annual capital raised for Funds of Funds (FoF) experienced a significant slump, totaling $31.7 billion, hitting a fundraising low last observed a decade ago in 2013. This decline in traditional FoF can be partially attributed to the emergence of evergreen and perpetual capital vehicles. Historically, traditional FoF provided access to institutional investors unable or unwilling to commit capital to direct funds, attracting small LPs and new entrants seeking a simplified way to access diversified assets and top-performing GPs. While funds over $1 billion attracted the largest share of FoF capital in 2023, the year-over-year dollar amount decreased by over half. Regionally, FoF capital raised from North America saw a significant year-over-year drop, while capital raised from Europe increased, representing 35.2% of overall 2023 capital. Conversely, FoF capital from Asia decreased slightly from 2022.

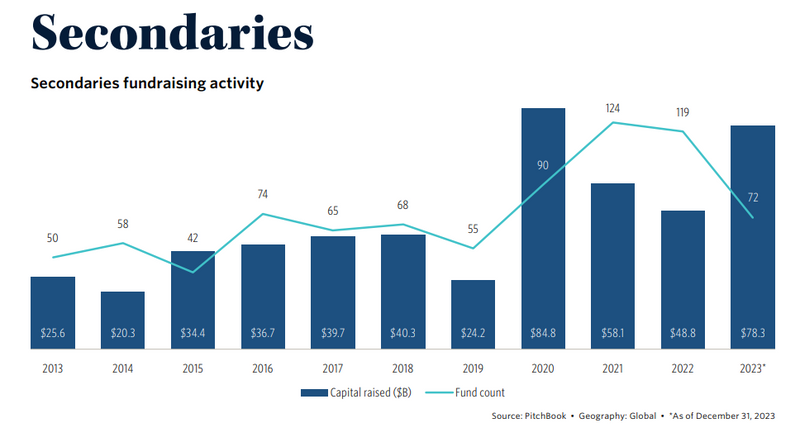

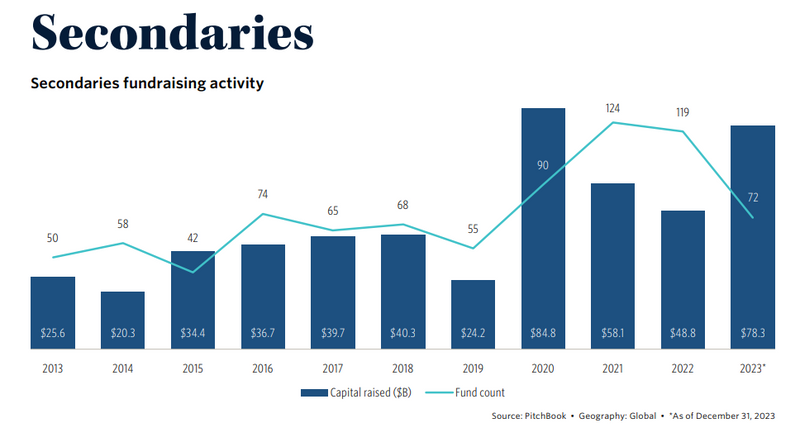

Secondaries Surged to its Second-Highest Level in a Decade

In 2023, secondaries fundraising surged to its second-highest level in a decade, totaling $78.3 billion across just 72 funds, marking a remarkable 60.5% increase from the previous year. This notable uptick underscores the impact of a few exceptionally large fund closings on the year's fundraising landscape, with four funds over $5 billion accounting for a staggering 60.7% of the total. Notably, Blackstone’s Strategic Partners Secondaries IX, closing at $22.2 billion, led the pack, contributing 28.4% to the overall fundraising. While many top funds expressed interest in both LP-led and GP-led secondaries, Blackstone’s Strategic Partners GP Solutions and Ashbridge Transformation Secondaries Fund II stand out for their specific focus on GP-led opportunities, driven by the belief in the potential for outsized returns. Despite the absence of venture secondaries funds in the top 10 list, these funds experienced their second-best fundraising year in 2023, raising $3.0 billion across 21 funds. North America led the fundraising charge, raising a record-breaking $64.6 billion, representing 82.5% of total secondaries capital, reflecting the region's dominant position in secondaries deal flow.