Private equity is transforming global business, but it remains shrouded in mystery for many. This guide will explain the basics of what private equity is and how leading firms operate.

We’ll start with an overview of what private equity entails. We’ll then explore how private equity firms structure funds, source and execute deals, create value at portfolio companies, and incorporate ESG factors.

What is Private Equity?

Private equity (PE) encompasses capital that is invested in private companies, or companies that are not publicly traded on a stock exchange. PE firms (general partners) raise pools of capital from investors (limited partners) like institutional investors, high net-worth individuals (HNWIs), and family offices, and then invest that capital in private companies they believe have strong growth potential.

As a PE investor, you essentially become a partial owner in the underlying companies the PE firm backs. While stocks allow you to buy shares in public companies, private equity gives you exposure to private ones. PE firms target companies across all industries and geographies, though technology and healthcare are popular sectors.

Unlike investing in stocks and bonds, private equity requires a long-term commitment. Investors' money is usually locked up for 5-10 years in a fund structure, with no liquidity during that time. The upside is PE investors have the potential to earn higher returns compared to public market investing by the end of that long holding period.

How Does Private Equity Work?

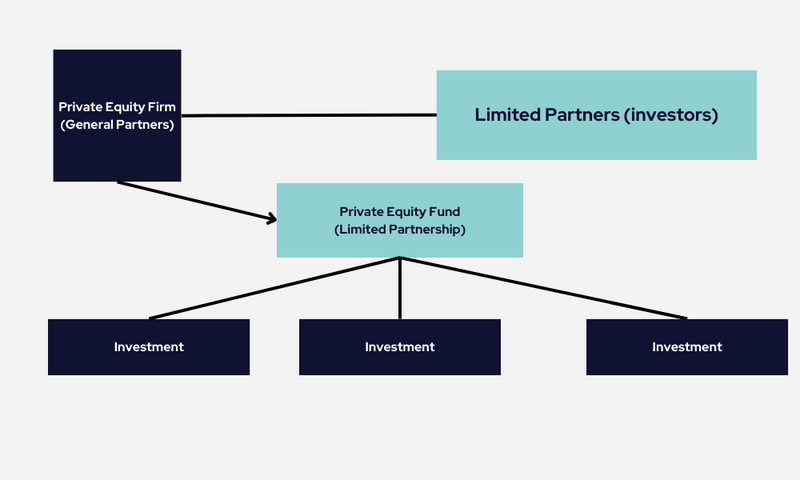

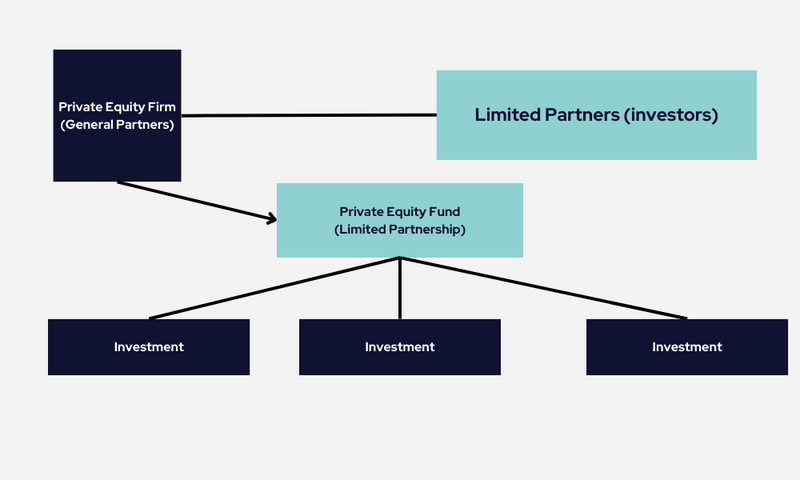

Like we mentioned above, PE firms raise capital through limited partnerships. The firm serves as the general partner overseeing the fund, while investors are limited partners providing the capital.

Once the fund is raised, the PE firm (general partner) deploys the capital into privately held companies. They target companies they believe are undervalued, underperforming, or distressed and have potential for operational improvements. The firm conducts due diligence to assess risks and opportunities.

If due diligence is favorable, they negotiate terms and execute deals to acquire companies or stakes. The PE firm then implements changes aimed at boosting the company’s growth and operations to create value.

After a holding period of 3-7 years typically, the end goal is for the PE firm to exit each investment at a profit, usually through an acquisition or initial public offering (IPO). PE firms aim to sell the companies for 2-4X their initial investment or higher. Returns from successful exits are delivered back to the fund's investors (limited partners).

For example, in July 2020, EQT Private Equity acquired Schülke, a Germany-based provider of infection prevention and treatment solutions for the healthcare industry,

Under EQT's ownership, Schülke delivered double digit annual revenue growth and nearly doubled core healthcare EBITDA. In August 2023, EQT announced the sale of Schülke to a consortium led by Munich-based ATHOS, a healthcare and life sciences focused single family office.

Value Creation and ESG

Value creation is at the heart of what private equity firms aim to achieve. Though often villainized as ruthless cost-cutters, the reality is more nuanced. Top PE firms excel at finding untapped potential in companies and working closely with management to realize that potential through operational improvements, strategic repositioning, and financial engineering.

This value creation mandate manifests in how PE firms approach ESG (environmental, social, and governance) factors. Rather than box-checking or PR exercises, ESG is integral to the PE value creation toolkit. Strong ESG performance - reducing energy usage, ensuring worker safety, diversifying leadership - directly translates to a more valuable company.

Take energy efficiency. PE firms often invest in dated manufacturing facilities and commercial buildings. By methodically analyzing and upgrading equipment, processes, and systems, PE firms can significantly reduce energy consumption and costs. These savings directly boost the bottom line, making the company more profitable and valuable.

Or look at governance reform. PE firms install best practices around financial reporting, internal controls, and board oversight. This reduces risk, avoids fines and disasters, and signals to potential buyers that the company is well-run. A strong governance profile makes the company more appealing to purchasers and investors.

In essence, ESG is not some peripheral initiative. It is a set of management best practices that allow PE firms to maximize value in their portfolio companies. ESG is the lens through which operational excellence is achieved. Far from being divorced from the PE model, ESG principles are integral to how private equity creates immense economic value.

Common Private Equity Strategies

Private equity firms pursue various strategies based on the types of companies they target and the approach for creating value. Here are some of the most popular strategies:

This traditional strategy uses debt financing to acquire mature companies that generate stable cash flows. By improving operations and cutting costs, the equity value rises over time.

Examples:

- KKR - Acquired Dollar General in 2007 for $7.3 billion, improved operations and expanded the chain, then took it public again in 2009.

- Blackstone - Took Hilton Hotels private in 2007 for $26 billion and improved its performance before re-IPO'ing in 2013.

With this approach, private equity firms invest in relatively mature startups and small companies poised for rapid growth. The goal is to scale the business by providing operational expertise and access to networks.

Examples:

- General Atlantic - Invested in Airbnb in 2011 and helped expand it from a small startup to a leading global hospitality platform.

- Summit Partners - Provided growth capital to Fitbit in 2013 to scale up sales and marketing for its wearable devices.

VC firms provide funding for early-stage and emerging companies. These startups need capital and guidance to develop and commercialize innovations with market potential. Risk and reward are highest with venture capital deals.

Example:

- Sequoia Capital - Invested early in tech companies like Apple, Google, LinkedIn, and WhatsApp.

Some private equity firms specialize in turning around struggling or restructuring companies by acquiring distressed debt and using recapitalization and reorganization strategies.

Example:

- TPG Capital - Took struggling retail chains J. Crew and Neiman Marcus private in leveraged buyouts to restructure their heavy debt loads.

As you can see, private equity firms target a range of companies across different stages of development and financial health. The unifying theme is driving transformative change to unlock value.

Conclusion

Private equity is a complex industry with its own language and intricacies. While this article has provided an simplified overview of private equity fundamentals, there is no substitute for learning from experienced professionals directly involved in the industry.

The best way to truly understand private equity and venture capital is to engage with the people who live and breathe it every day. Our upcoming networking conferences offer an invaluable opportunity to connect with hundreds of PE and VC leaders.

By attending these dynamic conferences, you can get your pressing questions answered, gain key insights from insiders, and expand your professional network. There is no better way to dive deeper into private equity and venture capital than learning from and networking with the experts themselves.